lincoln ne sales tax increase

The sales tax increase would generate about 13 million a year for a. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

/cloudfront-us-east-1.images.arcpublishing.com/gray/XU7MP46IHVNQTC2WUOS4LOEBZQ.jpg)

Future Hotel At 9th And O Expected To Open March 2021

The December 2020 total local sales tax rate was also 7250.

. The official final results show 5065 percent of people are for the quarter cent sales tax. Web The Lincoln sales tax rate is. Esposito said theres a lot of support for the idea.

The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1. Soldier For Life Fort Campbell. Replacement of the Citys emergency 911 radio system and the construction andor relocation of four fire stations.

KOLN - The Lincoln Police Department has arrested an 18-year-old for a stabbing that occurred during a fight at an apartment complex at N 1st Street and Belmont Avenue Tuesday night. For tax rates in other cities see Nebraska sales taxes by city and county. Lincoln voters approved the 14-cent increase in April to support two important public safety projects.

Web The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent t o 175 percent beginning October 1. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Learn all about Lincoln real estate tax.

Web Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio system and build four new. Web The Nebraska state sales and use tax rate is 55 055. Web Lincolns City sales and use tax rate will increase from 15 to 175 on October 1 2015.

Web The current total local sales tax rate in Lincoln NE is 7250. Web In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. Lincoln Ne Sales Tax Rate Mei 15 2021.

Sales tax permit holders need to prepare to collect sales tax at the new rate when this increase goes into effect this fall. To offset the impact of the sales tax on new homes and businesses a separate resolution will be introduced to freeze impact fees at the December 31 2018 rate for five years if voters approve the quarter-cent sales tax increase. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

Web The Nebraska state sales and use tax rate is 55 055. Web The quarter-cent increase would cost the average Lincoln household about 31 annually. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements.

Web The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect. Web In a very close vote Lincolnites approved a quarter-cent city sales tax hike Tuesday that will add a penny to the cost of a 4 cup of coffee and bring in an estimated 13 million a.

Lincoln voters approved an increase in the citys sales tax Tuesday to raise 345 million to build new fire stations and. Web 2 days agoLINCOLN Neb. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

Web A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Web April 8 2019 1112 pm. LINCOLN NE Americans for Prosperity-Nebraska today urged the Lincoln City Council to abandon Mayor Chris Beutlers proposal to include a 13 million annual sales tax hike on the April 9 primary ballot.

The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. The Nebraska state sales and. Web It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1.

A no vote was a vote against authorizing the city to. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. By 2021 the total will triple to 53 with the Lincoln Division accounting for just 217 of the bill total tax.

Web 926 P Street Lincoln NE. There is no applicable county tax or special tax. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent.

It was approved. Web The Nebraska state sales and use tax rate is 55 055. Web The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent.

Web 025 lower than the maximum sales tax in NE. You can print a 725 sales tax table here.

City Of Lincoln Looks 30 Years Into Future Sees Growth East South And Building In Existing Neighborhoods Local Government Journalstar Com

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

3540 Prescott Ave Lincoln Ne 68506 Realtor Com

Taxes And Spending In Nebraska

City Of Lincoln Looks 30 Years Into Future Sees Growth East South And Building In Existing Neighborhoods Local Government Journalstar Com

What S The Car Sales Tax In Each State Find The Best Car Price

City Of Lincoln Looks 30 Years Into Future Sees Growth East South And Building In Existing Neighborhoods Local Government Journalstar Com

University Of Nebraska Asks Herbster Pillen And Lindstrom To Stop Using Its Imagery In Ads Education Journalstar Com

Nebraska Vr Career Pathways Advancement Project Cpap 2 0

Illinois Doubled Gas Tax Grows A Little More July 1

11901 Middle Fork Rd Lincoln Ne 68526 Realtor Com

City Of Lincoln Looks 30 Years Into Future Sees Growth East South And Building In Existing Neighborhoods Local Government Journalstar Com

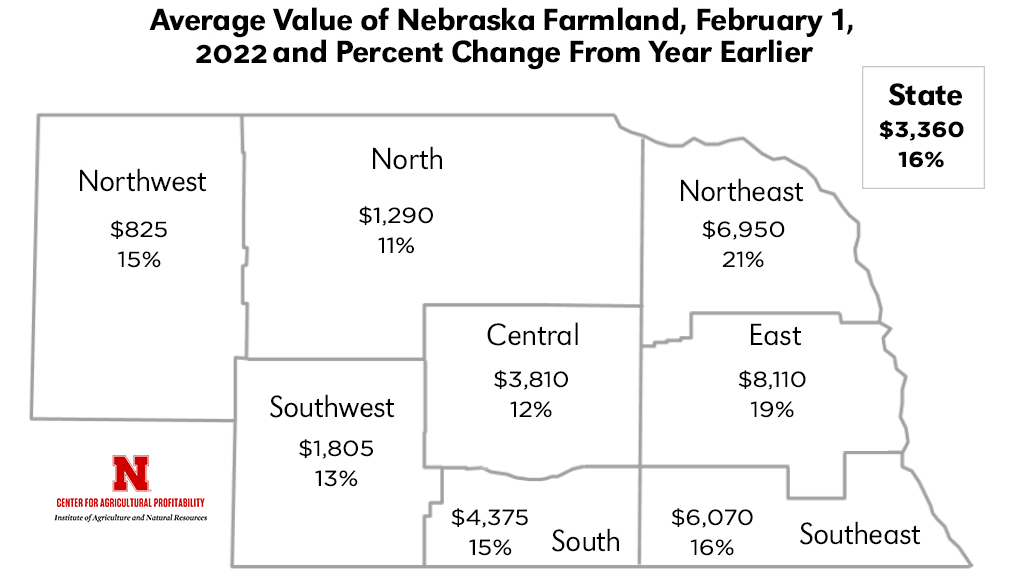

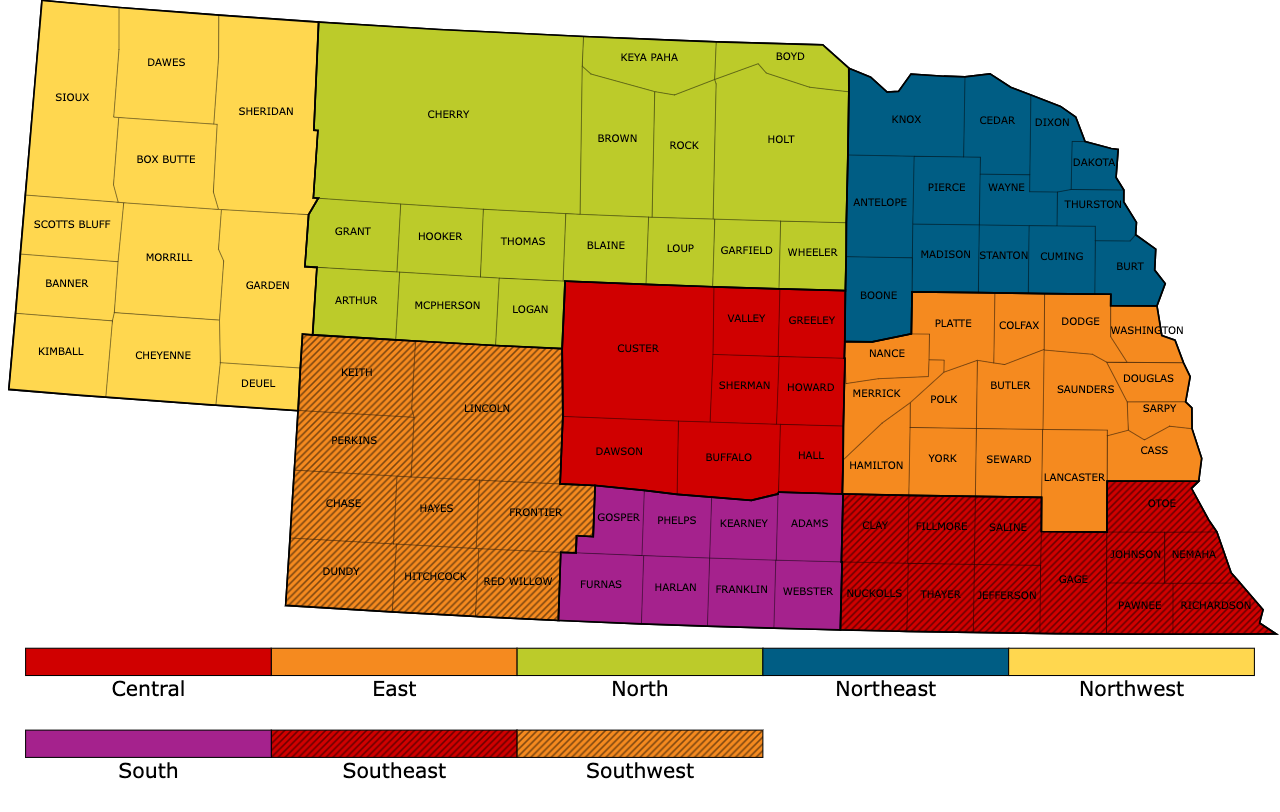

Nebraska Farm Real Estate Report Center For Agricultural Profitability

City Of Lincoln Looks 30 Years Into Future Sees Growth East South And Building In Existing Neighborhoods Local Government Journalstar Com

Nebraska Farm Real Estate Report Center For Agricultural Profitability